How Indian Entrepreneurs are Changing the World

Entrepreneurs are the people who move industries forward. Without entrepreneurs, innovation would come to a halt and large, bureaucratic corporations would only make small, incremental improvements. From our point-of-view, entrepreneurs are some of the most important people in today’s society. Today we’ll present a list of just a few Indian entrepreneurs who are changing the way we live.

Azim Premji, known informally as “Czar of the Indian IT Industry”, started from humble beginnings after taking over his father’s cooking oil business and turning it into one of the largest IT companies in the world. Western India Vegetable Products, which was the company his father founded, made the transition to the Information Technology field after Azim came back from Stanford University and changed the name to Wipro. There was substantial opportunity for growth when IBM was forced to leave India, leaving a large vacuum that needed to be filled.

Azim is now the second richest man in India with reported net worth of $18.3 billion dollars. Information technology is still a field ready for disruption because of the ever-improving nature of technology. Essentially, every one to two years, new and more powerful technology is introduced to consumers.

Girish Mathrubootham is the founder of Freshdesk, (now Freshworks Inc.) one of the leading customer support software systems on the market today. With over 100,000 customers (including Toshiba, Honda, Sony Pictures, Cisco, and many more) Freshworks is poised to be one of the leading business software companies in the world.

Business software is one industry where startups are creating positive change because old players, like Microsoft, Oracle, and others, are slow to implement change. They provide legacy software that is years behind where it could be. These large companies take too long to adapt and therefore open up space for new companies to come in and capture market share.

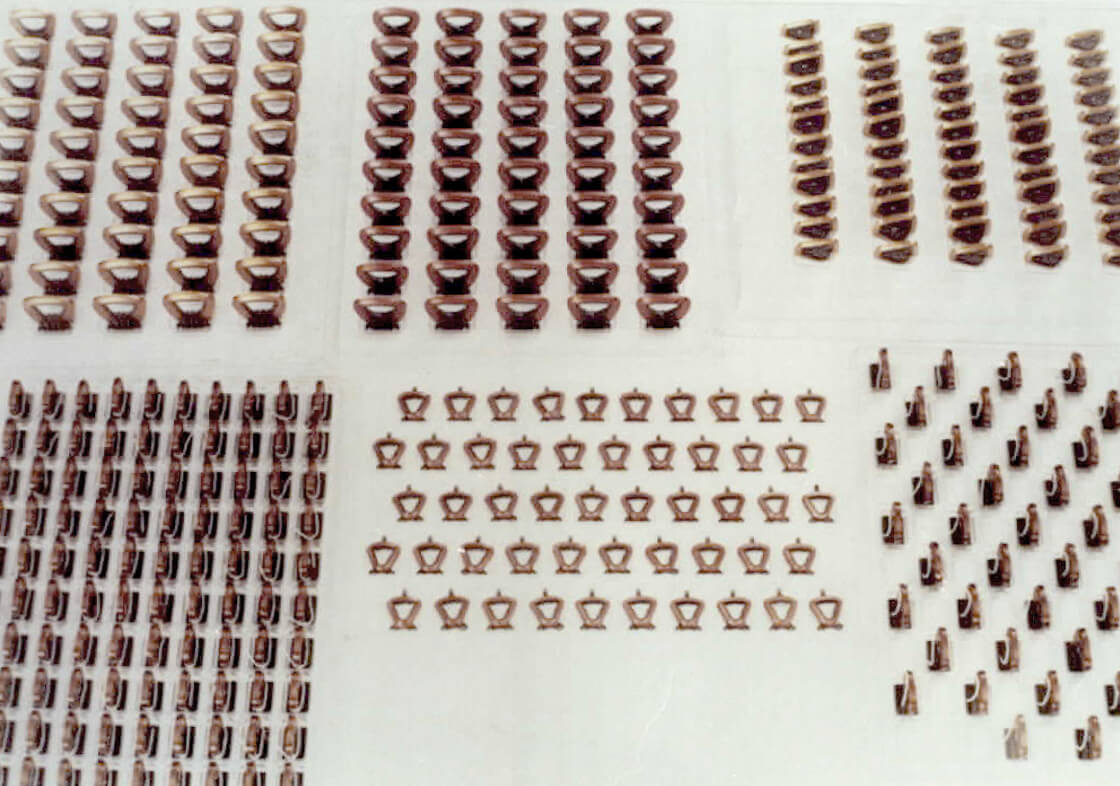

Kailash Katkar is the founder and CEO of Quick Heal Technologies LTD. Quick Heal is one of the pioneers of research and development for the IT security industry. Quick Heal offers antivirus protection for PCs, laptops, Macs, and smartphones. They also offer enterprise IT Security Solutions for larger companies that can protect an entire work force.

IT security will be one of the most important sectors needing innovation in the foreseeable future. Large scale IT hacks, like the recent Equifax breach, show just how important security can be. Over 143 million Americans had their confidential information stolen by hackers who were able to break into Equifax databases. A large scale breach like this could happen in India as well, which is why investing heavily in IT security will be a top priority in coming years.

Kunal Shah is the co-founder of Freecharge, along with Sandeep Tandon. Freecharge is an e-commerce website headquartered in Mumbai and provides online facilities to recharge any prepaid mobile phone. In April of 2015, Freecharge was acquired by Snapdeal for approximately $400 million (US) and has been referred to as the second biggest acquisition in Indian history.

Mobile technology is one industry most poised for rapid change as a large base of the indian population are now using mobile devices. Faster wireless internet will provide enormous opportunities for new companies to provide innovative products and services that a +1 billion person market will have access to.

Sridhar Vembu is the founder of the Zoho Corporation. He has been the CEO since 2000 and is famously known for turning down venture capital money and building his company internally. Sridhar proves that it’s possible to grow a large tech company (that can compete with companies like Oracle, Salesforce, QuickBooks, and Microsoft) without taking on large amounts of venture capital.

In business software applications, customer support is often a neglected aspect customers are forced to deal with. Zoho prides itself on being one of the only companies that puts customer service above everything else. Instead of relocating and building his company in Silicon Valley, Sridhar decided to stay in India. He built his company locally by teaching high school students how to program and then hiring them as developers himself.

Will you be an influential Entrepreneur?

If you’re working on being an influential entrepreneur yourself, the Tandon Group wants to help you along the way. At the Tandon Group, we’ve invested in the dozens of high-growth startups in the consumer, defense, and information technology sectors, across the globe. We’ve had successful exits and helped grow companies to millions of users. If you know your company has the potential to be the “next big thing”, reach out to us. We’d love to be your partner for the road ahead.